Grants to Charities

Approved Grants

UI Charitable Advisors supports clients' philanthropy by offering opportunities to help them target and fund the causes and organizations they care most about.

Grant to US-based 501(c)(3) charities and churches: There are over 1.1 Million nonprofits and US charities in the UI database, which pulls directly from the IRS’s list of approved nonprofits. Grants to IRS-approved 501(c)(3)s can be requested through the Donor and Advisor Portals.

International Grants: Advisors or their clients can recommend an international grant from the UI Donor Portal. The UI Charitable Advisors team will review the recommendation, perform the IRS-required due diligence, and, once approved, distribute the funds to the chosen organization.

Impact Investments: Clients can use their DAFs to invest in for-profit socially or environmentally-focused ventures. Impact investments aim to generate both social impact and financial returns.

UI Impact Recommendations: A list of recommended impact organizations can be found in the Donor Portal. The selected entities are focused on supporting and driving impact around the world.

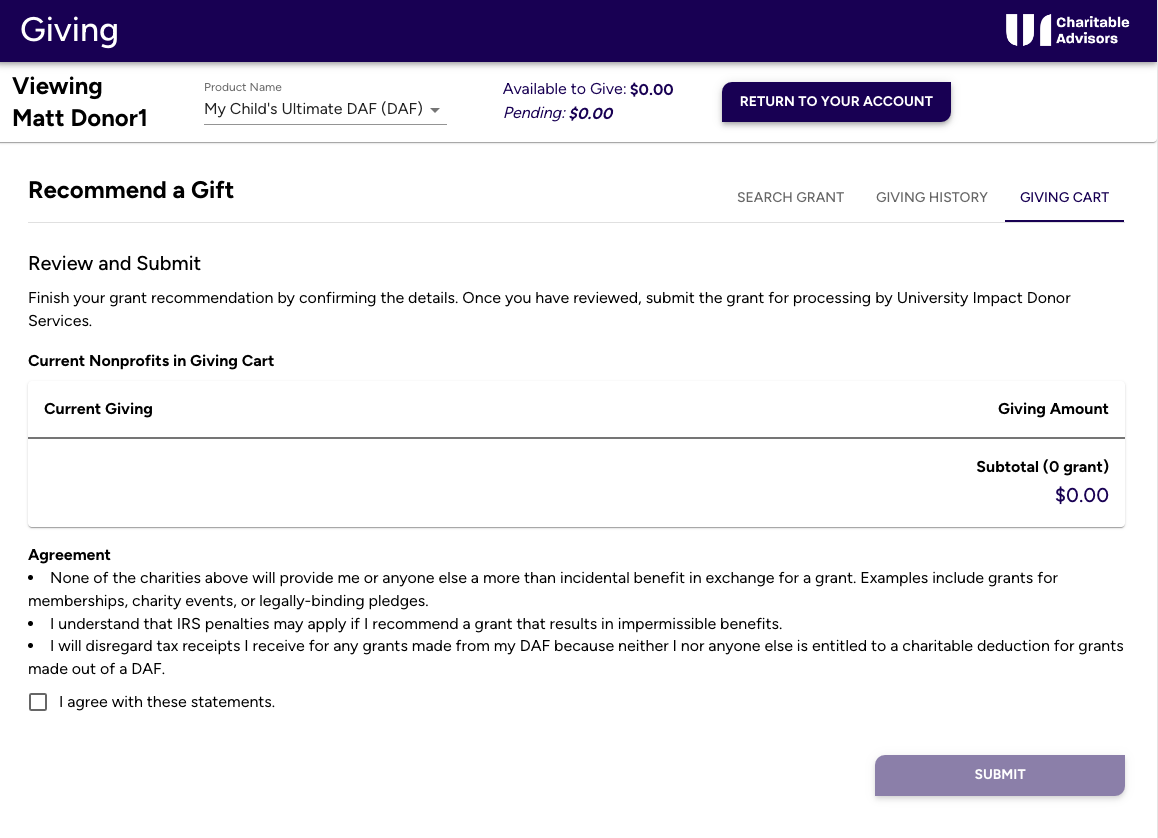

Prohibited Grants

UI Charitable Advisors is required to abide by IRS regulations when it comes to grantmaking from a UI DAF. There are 3 main restrictions:

No Direct Benefit to the Donor

The donor, their relatives, and their associates may not receive any services, goods, or any other benefit that is more than incidental, because of their grant. A benefit is considered more than incidental if any disqualified person receives a benefit that could reduce or eliminate a charitable deduction as a result of the grant.

This includes the following situations:

Receiving goods or services at or below their Fair Market Value.

Admission to a fundraising event such as a gala or auction paid for in whole or in part by the grant.

Paying for membership privileges, in whole or in part.

No Control over the Grant Recipient:

Donors are prohibited from making grants to individuals with whom they have affiliations, especially where such individuals directly benefit from the grant.

For example:

Financing a scholarship when the donor plays any role in selecting the recipient.

Contributing to a specific missionary project led by an individual related to the donor.

Supporting political campaign activities, contributions, or lobbying endeavors.

No Legally Binding Pledges/Commitments:

Donors are not permitted to utilize DAF funds to fulfill legally binding pledges or fundraising commitments. Fortunately, many pledges or commitments are non-binding. The charity can ascertain the binding nature of your commitment.

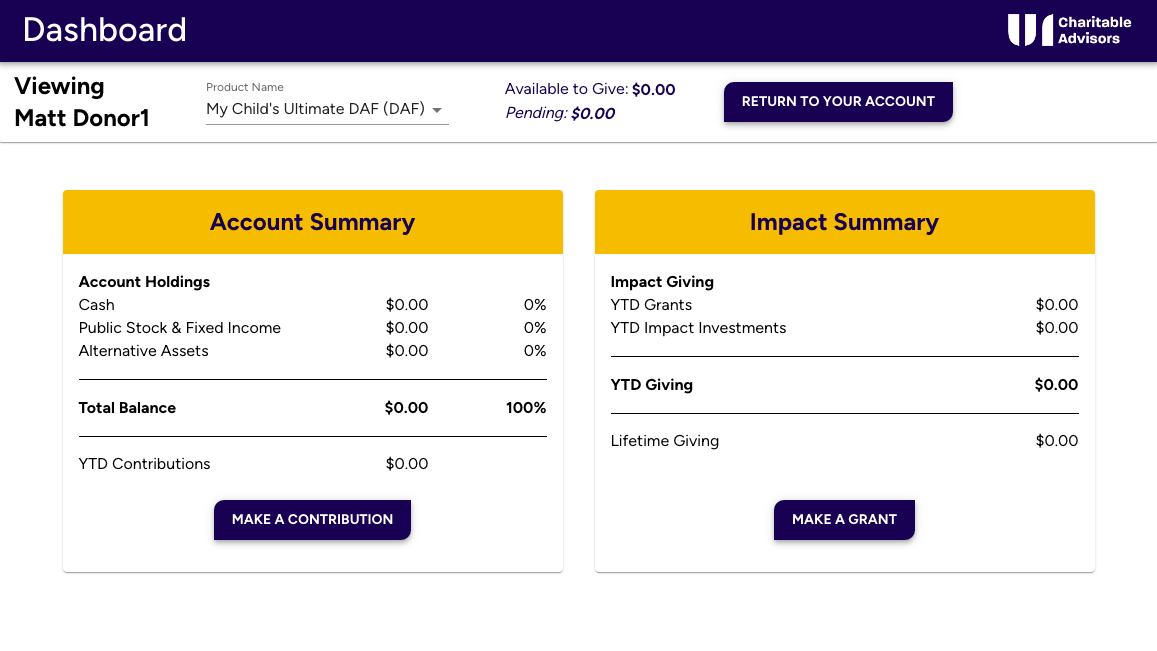

How to Give from a UI DAF:

Clients can recommend grants and impact funding directly from their online portal accounts:

Advisors can support clients by facilitating grants through the Advisor Portal. Advisors can recommend grants or impact funding opportunities on clients’ behalf.

Need help making a grants request? Please contact support@uicharitable.org